Exponential Growth Case Study By Adrian Ulsh

I want to show you one of the most powerful tools you should be using with every client you coach, and that’s the sheer power of exponential growth.

I want to explain it to you, and then show you how you can apply it to your prospect’s Profit and Loss statement, often referred to as their P & L.

Why is this important? You will be able to IMMEDIATELY generate an additional $5,000 to $15,000 in bottom-line revenue for ANY business owner.

By doing so, you can now say to any prospect that your first $1000 monthly coaching fee is basically free, and that you will pay them an additional $4,000 – $11,000 for the privilege of coaching them. Talk about a compelling offer!

P & L Statement

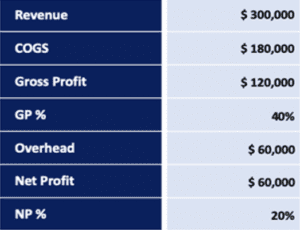

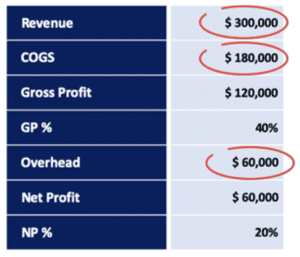

So, let’s begin by examining the P & L statement. Here is a standard template for your typical P & L.

As you can see, it consists of just 7 basic sections… revenue… COGS – commonly referred to as Cost of Goods Sold… Gross Profit – which is calculated by subtracting your COGS from your revenue… Gross Profit percentage – which is calculated by dividing your Gross Profit by your revenue… Overhead – which represents the bills you have to pay every month… independent of whether you make a sale or not… Net Profit – which is your Gross Profit minus your Overhead… and Net Profit percentage – which is calculated by dividing your Net Profit by your revenue.

As a coach, you can impact only three of these, and those are revenue, cost of goods, and overhead. I will define these for you in an example shortly.

Let’s assume this sample P & L is for a make-believe widget company. Let’s assume this company sold $300,000 worth of widgets over the past 12 months.

They spent $180,000 in material and labor to build the widgets, so we record that number as their COGS. We subtract that number from their $300,000 revenue to find our Gross Profit, which is $120,000.

We divide $120,000 by our $300,000 revenue to find our Gross Profit percentage – which comes out to be 40%.

This widget company has $60,000 in Overhead costs – this represents their bills. Now we subtract our $60,000 overhead from our $120,000 Gross Profit to find our Net Profit which comes out to be $60,000.

And finally, we divide our $60,000 Net Profit by our $300,000 revenue which gives us a 20% Net Profit percentage.

As you can see, there’s really nothing complicated about a P & L at all, but I know that when it comes to interpreting these numbers… and using them to help grow your client’s business… it can seem complicated… so here’s some good news for you as a coach.

There are only THREE numbers you really need to focus on in any P & L statement – revenue, COGS, and overhead.

The reason these three are so important has to do with the simple fact that these 3 are the only numbers in your P & L that you can directly impact.

The remaining 4 numbers are all determined by these 3. You find gross profit by subtracting COGS from revenue, and then dividing that number by the revenue gives you the gross profit percent.

When you subtract your overhead from your gross profit, you find your net profit… which you then divide by revenue to determine your net profit percentage.

So, the 3 numbers you can directly impact… and the ones we’re going to focus on to help you find dramatic financial gains with ZERO cost… are revenue, COGS and overhead.

Revenue

Let’s begin with revenue – in our widget company example, we said our revenue was $300,000. But what exactly is revenue?

Revenue is the total amount of sales recognized for a specific reporting period, prior to any deductions. When you sell something, it’s the total amount you collect from that sale.

This figure is obviously important as it indicates your ability as a business to sell your goods and services. However, it does NOT indicate your ability to generate profit.

How often do we hear of businesses today that are making millions of dollars but have no profits whatsoever?

But we can directly impact revenue in such a way that we can see dramatic revenue gains WITHOUT relying on marketing and advertising, which can run up our expenses big time. We’ll explain how shortly.

Cost of Goods Sold

Let’s move to our second impact area – COGS or Cost of Goods Sold. In our widget example, we said our COGS was $180,000. COGS is defined as the costs incurred to deliver on your contract of sale.

These are costs such as: Labor (Direct and Contractual)… Materials… Scrap and Rework… Packaging… Distribution and Shipping… and Sales Commissions. In most cases, COGS will typically increase as your sales volume increases. There is one important point to remember about COGS.

COGS doesn’t exist if there is no cost to deliver whatever it is you sell. In most cases, this describes professional service providers such as business coaches, financial planners, web designers, chiropractors, law practices, consultants, accountants and business brokers.

The vast majority of these professionals dispense advice or services that have no real cost to deliver. The typical gross profit margin for these professionals can range from 50% to 95% percent.

So, they will only have two areas of impact on their P & L – revenue and overhead. There will be little to no impact we can make with COGS for these businesses.

And last but certainly not least is overhead… also frequently called fixed costs.

Fixed Costs

These are the costs you incur regardless of whether you make a sale or not. Overhead represents your daily, weekly and monthly expenses that are required to operate your business… such as your mortgage or rent, insurance, utilities office supplies, office salaries, general maintenance, regular ac maintenance, advertising, janitorial and your auto expenses.

The reason these costs are referred to as “fixed” has to do with the fact that these costs reoccur. Your rent or mortgage is always there… your utilities are always there. Not to mention the fact that these costs typically remain constant despite your sales volume

So, these are the only 3 numbers we want to focus on and improve in order to help us generate more profit for your business. Now, you may be asking yourself how these 3 numbers can generate any meaningful results that can significantly impact your business.

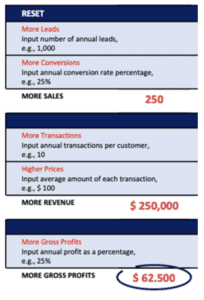

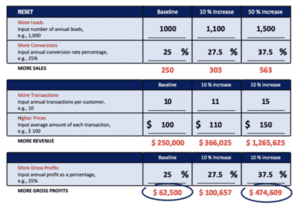

Let me introduce you to a tool we use to demonstrate a powerful concept know as exponential growth. We call this a Profit Growth Calculator. Let’s plug in numbers for a make-believe business.

Let’s say your business generated 1000 leads in the past year… and your average conversion rate was 25%. So your sales for the year total 250.

Let’s also say your customers bought what you sell 10 times throughout the year… and they typically paid on average around $100 per purchase. So your revenue for the year totals $250,000.

Finally, let’s say your profit margin per sale is only 25%. Notice at the bottom that you’re earning $62,500 annually.

But look what happens if we simply increase each of these 5 areas by a meager 10%.

You would see your profit almost double… from $62,500 to over 6 figures. Our profit just increased by 62%. By the way, there’s nothing wrong with a 10% gain in these 5 areas. Most business owners would KILL to almost double their profits.

But watch what happens if you could increase each of the 5 areas by 50%.

Your profit would skyrocket from $62,500 to almost half a million dollars annually. That’s a 760% increase!

When you know and understand the power of exponential growth, you can literally transform any business. Now, you may be thinking that 50% gains in each of these 5 areas would be next to impossible.

Let me assure you that a 50% increase is child’s play. And now that you understand the principle behind exponential growth, let’s use a similar approach to generate immediate cashflow for your business.

Remember, we ONLY need to focus on these 3 numbers in your P & L. Suppose we could increase your revenue and decrease your COGS and overhead by just a miniscule amount – what would that mean to your bottom line? Let’s find out.

What would happen if we could increase your revenue by just 5%? Let’s continue to use our widget company’s P & L. Our original revenue figure was $300,000, so a 5% increase would increase that number to $315,000.

Our COGS stays the same at $180,000, but our Gross Profit has gone from $120,000 to $135,000… which in turn increases our GP percentage from 40% to 43%. Our overhead doesn’t change – we still have to pay our bill – so it remains at $60,000… but our new Net Profit has increased from $60,000 to $75,000.

So a measly 5% revenue increase results in a $15,000 gain in our net profits.

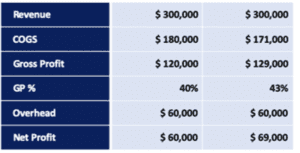

Now let’s see what would happen if we lowered our COGS by just 5%. Let’s start with our baseline template.

Obviously, our revenue remains at $300,000. Our Cost of Goods Sold drops 5% from $180,000 to $171,000. That increases our Gross Profit from $120,000 to $129,000. That increases our Gross Profit percentage from 40% to 43%. Our overhead remains at $60,000. But our Net Profit increases from $60,000 to $69,000. So that meager 5% decrease in our COGS increased our bottom line by $9,000.

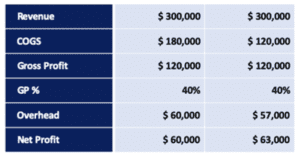

Let’s try the same thing with our overhead and lower it by 5%. Again, we start with our baseline template. Our revenue, Cost of Goods Sold, Gross Profit and our Gross Profit percentage all stay the same.

But let’s lower our overhead 5% which drops it from $60,000 to $57,000. That increases our Net Profit from $60,000 to $63,000. So, a small 5% decrease in our overhead increased our bottom line by $3,000. But what does all of this mean?

Remember our Profit Growth Calculator we used earlier to demonstrate the awesome power of exponential growth? If we achieve small increases in just a few areas, we see a dramatic impact on our bottom line.

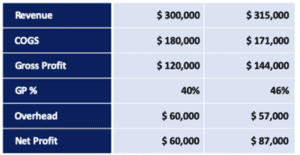

So, what if we impact ALL three areas by 5%. Let’s start with our baseline template.

Let’s increase our revenue by 5% from $300,000 to $315,000. Let’s drop our Cost of Goods Sold by 5% from $180,000 to $171,000. Our Gross Profit now increases from $120,000 to $144,000. That increases our Gross Profit percentage from 40% to 46%. Our overhead drops 5% from $60,000 to $57,000. And our Net Profit soars from $60,000 to $87,000. So, a meager 5% impact in these three areas increased our bottom line by a whopping $27,000.

And here’s the best part of this process – none of this cost us a cent to do it. This is a simple and pain-free way to increase your bottom line at zero cost… and you can do this in a matter of days.

I’ll explain how in the next few magazine articles. But ask yourself this – how do most business owners attempt to increase their profits?

EASY! They immediately implement a marketing program. OK, there’s absolutely nothing wrong with doing that, but consider the numbers involved if you do.

What would it take to generate that additional $27,000 we just found through a marketing program? Here’s a simple way to calculate this – so make a note how we do this so you can use it moving forward.

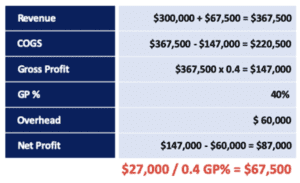

The magic figure in the profit and loss statement is the Gross Profit percentage, which in our example was 40%. You divide your exponential profit increase which we calculated to be $27,000 by your Gross Profit percentage of 40%, which in a decimal format is 0.4… and you get $67,500.

But is that really the correct number? Well, let’s plug it into our P & L and find out.

Our previous revenue was $300,000 and now we add that $67,500 to it equaling $367,500. Since we know our Gross Profit percentage is 40%, we can find our Gross Profit by multiplying our new revenue of $367,500 by 0.4… and we get $147,000.

We also know that our COGS and Gross Profit always add up to our revenue, so we can simply subtract our Gross Profit of $147,000 from our revenue of $367,500 and we get $220,500 for our Cost of Goods Sold.

Our overhead doesn’t change – we still have to pay our bills, so it remains at $60,000. And now we subtract our overhead from our Gross Profit and find that our Net Profit equals $87,000. $87,000 is exactly $27,000 greater than our original Net Profit of $60,000, so we have confirmed this equation works.

So, to generate $27,000 with a marketing program, we would need to increase revenue by $67,500. But hold on! That assumes the marketing program you implemented is FREE! Most businesses today are marketing on Facebook, and that is often expensive.

That’s why we say that exponential growth is the KEY to bigger profits for your business. By impacting your revenue, COGS and overhead by just 5%, you can often see dramatic increases in revenue and profit.

There’s nothing wrong with implementing a marketing program, but why not start here and use your financials to jumpstart your profits? And remember, there’s ZERO cost involved in following this process.

One more thing these increases are NOT just a one-time thing… these continue year after year.

Now that you understand exponential growth, use it to dominate as a coach.

About Adrian Ulsh

Adrian Ulsh is the Senior Executive Director at Focused.com, the largest online provider of coaching services worldwide. Adrian currently works with more than 500 coaches in 24 countries advising them on building 6 and 7 figure coaching practices.