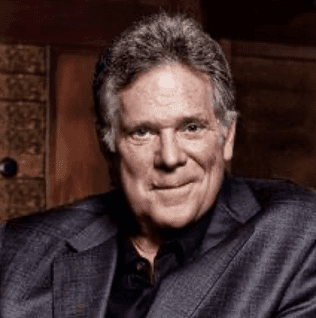

Crisis Leadership: Do Your Job By Keith J. Cunningham

Over the last two weeks, I‘ve held dozens of Board of Directors meetings and one-on-one deep dives with scores of business owners around the world.

Every one of these business owners is dealing with uncertainty and a crisis of some sort. Some are more serious than others, but none are immune.

I am confident the insights, strategies and optics we discussed in our recent meetings will be invaluable for you as well.

The following are some critical takeaways from these Board sessions as well as fodder for your future Thinking Time.

If you are unfamiliar with this concept, a full description of Thinking Time is provided in my book, The Road Less Stupid, but to get started immediately: close your door, turn off your phone, grab a pen and tablet, and start answering the questions below.

Cursing the wind and screaming at the rain does not stop the hurricane or ensure your safety and survival.

Wishful thinking and relying on the Law of Attraction is equally insane.

Only mentally unstable people walk out their front door in the middle of a Cat 5 hurricane and curse their misfortune.

Playing the hand you have been dealt is the only choice you have if you expect to survive.

Always remember, it is not the hand you have been dealt but how you play the hand that determines whether you will win the game or live to fight another day.

Kenny Rogers said it best: “…every hand’s a winner and every hand’s a loser….”

Question:

What do I need to do immediately to ensure my survival and stability?

In business, there are times that call for the warrior and others that call for the general. In a crisis, having a warrior fight the day to day battles is critical. But the goal is not to win every skirmish and battle, it’s to win the war… and that requires a general.

General Eisenhower never dropped a bomb and General Patton never fired his custom engraved, pearl-handled, Smith & Wesson .357 Magnum, but they won the war.

Winning this war will be more dependent on the thinking and planning you do than on the number of bullets you fire.

Running the wrong direction enthusiastically is a prescription for disappointment in normal times and disaster in bad ones.

Here It Is On A Bumper Sticker:

Cash and cash flow win economic wars.

Question:

What are the smart strategic moves I need to make to increase my odds of winning this war?

What do I need to do to ensure survival?

How can I preserve the oxygen in my tank?

There are only two primary outcomes in this environment:

(CM) ⎫Survival (dry powder)

(CM) ⎫Stability (cash flow neutral or better)

Question:

How much are my cash reserves and how do I make sure I am not depleting them with excess spending today?

No one knows how long this will last, how deep it will go, what things will look like when the quarantine and social distancing are over, or how quickly or slowly the economy, your industry, or your customer base will rebuild.

One thing is certain though, few of our businesses will look exactly like they did before.

Question:

When I do my planning and thinking, is my business more likely to resemble a rubber band (snap back into place) or a ramp after the crisis?

How will my business need to adjust to new consumer expectations following the crisis?

Optimism and emotions will result in hanging on too long and not cutting deep enough or fast enough.

The second-order consequence of that is running out of peanut butter and jelly sandwiches…

In 2017, an assistant soccer coach in Thailand organized an afternoon hike for the Wild Boars (his junior team) through some caves outside of town following their practice.

The twelve teenage boys had stopped at a local convenience store for snacks prior to the hike, so when they entered the cave, they had the equivalent of four peanut butter and jelly sandwiches between them.

It began to rain while they were exploring the cave and the cave’s only entrance (and exit) was quickly submerged in water, leaving the boys and their coach trapped.

As the water rose, the soccer coach led them deeper and deeper into the cave system in order to find higher ground. Their rescue involved pumping a billion liters of water and over 10,000 people: 100 divers, representatives of over 100 governmental agencies, 900 police officers, 2,000 soldiers, ten police helicopters, and 700 dive tanks.

All in all, it took 12 days to find the boys and another six days to rescue them.

Amazingly, all the boys were alive and successfully rescued. The incredible part of this story is that once the team was found, they still had one and a half peanut butter and jelly sandwiches.

Here Is The Moral Of This Story:

If you don’t know how long a crisis is going to last, you better make sure you can stretch what you do have to last as long as possible.

Question:

How can I preserve and stretch my existing capital so I can extend my survival?

Optics, flexibility, and speed are mandatory.

Although you may not like my example, it is accurate and insightful: There is only one reason Kobe Bryant is dead.

When it gets foggy and visibility is zero, you cannot fly your helicopter by looking out the window.

Kobe’s pilot did not have the dials in his cockpit that would have enabled him to “see” where he was and to give him instantaneous feedback in order to dodge the mountain, yet stupidly, he kept flying.

It is deadly to believe you can navigate in this environment without dials and optics… It is simply too foggy.

The most critical dial in your cockpit is the Rolling 13 Week Cash Flow Forecast.

It must be accurate, updated constantly, and executed consistently. The margin for error is razor-thin!

Question:

How up-to-date and accurate are the dials, dashboards, and optics in my cockpit? Are any of my gauges flashing red?

For those of you unfamiliar with the Rolling 13 Week Cash Flow Forecast, it is very different from your annual budgeting ritual.

In normal times, if you get a couple of quarters into the year and find you are 15 or 20% off your quarterly or annual budgeted target, nothing bad typically happens.

In a crisis, cash flow forecasting requires an entirely different level of intensity and engagement.

If you put in the effort to do the cash forecasting, you MUST run your business according to that plan.

Mistakes on execution with cash and cash flow are deadly in a crisis.

Question:

Is my cash forecast realistic and are we hitting our plan? If not, what must change immediately?

There’s a tendency when developing the Rolling 13 Week Cash Flow Forecast to use the same methodology as we sometimes use when creating our annual budgets.

We often forecast an increase in sales of 20% and then budget for a big payroll jump or overhead in Q2.

These estimates are usually derived from wishful thinking and glossy assumptions.

The missing piece is the extreme granularity and specificity required to accurately predict either the forecasted revenue or the budgeted expenses.

I call this a Yellow Brick Road, Google calls it Google Maps.

In a crisis, Cash Flow forecasting requires a very sharp pencil, detailed amounts, specific dates, precise milestones, and clear triggers for adjustments, if necessary.

Few things are worse than being blindfolded and trying to catch a falling knife…. The people who try this trick usually have a nickname like “Stumpy.”

Question:

How can I turn my plan and cash forecast into Google Map directions: “Turn right in 100 feet, merge left at the intersection in ½ a mile, make a U-turn, and proceed to the route.”

The single most important ingredient to flexibility in a turbulent business environment is dry powder (cash on the sidelines).

In case you missed it in the news, thousands of the largest companies in the United States have drawn down 100% of their line of credit at the bank.

They have slashed payroll, furloughed millions of employees, and canceled billions of dollars of capital expenditures.

They don’t necessarily need the cash today, but since they don’t have clarity or visibility about the depth or duration of this crisis, they are opting for “safe vs. sorry.”

As we all know, banks are happy to loan you an umbrella when the sun is shining but want that umbrella back at the first hint of rain.

It’s better for you to have the dry powder than the bank.

Question:

How much is my actual dry powder and is there anything I need to or can do to augment it?

In 2001, a commercial airplane flew into a building and the world changed forever. Regardless of your opinion of him today, back in the day, Rudy Giuliani was considered a national hero.

As the Mayor of New York City on 9/11, he orchestrated the city’s response and is credited for preventing far more deaths.

A couple of years after this tragedy, Giuliani was asked how New York City was able to mobilize and respond to this crisis so quickly and effectively.

His response is a lesson for us today.

Giuliani said New York City had a “war room” at City Hall.

This room contained more than 50 different plans for responding to different potential crises.

There was a plan for a dirty nuke in New York Harbor and another plan in the event the water system was poisoned. There was a plan for a bomb in the subway system and a plan for a 100-story office building catching on fire.

When 9/11 happened, the leadership of New York City headed straight for the War Room and began pulling different response techniques from different plans. In less than 30 minutes, they knew what to do and how to do it.

Not because they had a plan for an airplane hitting an office building, but because they had so many other plans already developed.

Here is the message: You will need multiple plans on the shelf as this crisis winds its way through our economic system.

You need to develop a robust sensitivity analysis with varying assumptions for revenue, expenses, cash collections, cash burn, and timelines.

Waterfall or cascade your expense structure assuming various cash collections and revenue events.

No one has the ability to predict exactly what will happen next, but thinking about and developing various plans in the event of varying outcomes will guide and accelerate your response time and reduce the risk of getting caught flat-footed.

Question:

If I knew this crisis was going to last for another three or more months, what are the decisions I would make and what actions would I take?

When would I take them?

What if it was another six months instead of three?

When the crisis is over, what is your revenue for the following quarter?

What if it is less than 50% of your pre-crisis revenue? (In asking this question, I am not suggesting that timing is accurate, but rather challenging your assumptions and thinking to cause you to create some additional plans.)

Anyone who has ever flown American Airlines has experienced some version of this announcement at the departure gate: your flight has been delayed by 20 minutes.

30 minutes later, another announcement is made that informs you that it will be an additional 45 minutes before departure.

An hour later, they announce that the airplane scheduled to fly you to your destination has not left the tarmac at the city of origination, therefore, the airline cannot predict an estimated departure…but don’t leave the boarding area in case there is another announcement.

Question:

What does my plan look like if the scheduled end of the crisis begins drifting from my original plan?

Wall Street has a mantra: “Risk-on…Risk-off.”

When risk is “on,” the pros know it is time to be aggressive because the coast is clear; there are no thunder clouds on the horizon or hurricanes on the radar.

“Risk-off” is a time for extreme caution: The visibility is poor, the floorboards are rattling, and the roof is

leaking.

Question:

Do I think this is a “risk-on” or a “risk-off” environment? If you ponder this question and conclude it is “risk-on,” you might want to double check your assumptions about:

(CM) If this was a baseball game, what inning do you think we are in? Are we closer to the third inning or is this the seventh-inning stretch? Or is it the bottom of the ninth and the fat lady is clearing her throat?

(CM) The timeliness of collection of your accounts receivable and cash sales. What if a customer who owes you money goes broke or delays payment on your invoices to conserve their cash. Remember: Your accounts receivable are someone else’s accounts payable… and I don’t know anyone who is rushing to accelerate the payment of their AP.

(CM) The type of recovery we will have. Is it a “V” or a “U” or a Nike-style “swoosh”?

(CM) The profile of your customers and their appetite for your service(s) as previously configured and delivered.

(CM) The likelihood of a recurrence of this virus in the coming months and the timing of a vaccine.

(CM) The probability of future mandated shutdowns now that the glass has been broken on using quarantine and mandatory shelter in place actions to address this type of problem.

In chess, every player knows how the rook, pawn, and bishop move on the chessboard.

The only difference between a chess Grandmaster and a beginner is the Grandmaster has the ability to think 20+ moves into the future and a novice is capable of only two or three. The experts can all play three-dimensional chess in their heads. A critical component to your survival is checking your assumptions and predicting the probability of various second-order consequences.

In a crisis, play chess not checkers!

Checkmate is only one wrong move away.

Question:

Where is my “king” exposed and how do I shore up my defenses to minimize checkmate? (This is another way to get you to think about your cash, cash flow, and survival.)

One of the most painful expenses to reduce in a crisis is payroll.

The reasons are obvious.

As business owners, we typically know these people and hate the idea of hurting them financially with a layoff or furlough.

We tend to optimistically fantasize about the employees we will need when the crisis is over. I understand and empathize with you.

If you have an extreme amount of dry powder and can afford to retain employees even though your cash flow is negative, reducing your headcount might not be an immediate answer that you want to consider.

On the other hand, limited dry powder and retention of employees that cannot be justified by current revenue is a prescription for disaster.

The problem is NOT how you will deliver service in 90 days, the problem is can you survive, become financially stable, and avoid consuming all your peanut butter and jelly sandwiches before the crisis is over?

There must be a skeleton of a business for people to return to when you restart and that might not be possible without some hard personnel decisions.

You already know this, but airlines always advise parents traveling with kids to put their oxygen mask on before their child’s. Great advice!

Here it is on a bumper sticker: Lean beats fat unless you are a sumo wrestler or an offensive lineman for the New England Patriots.

While they both might be impressively strong, they have limited endurance. Imagine you were thrown overboard in the middle of the ocean, how long could you tread water?

Now imagine you were thrown overboard in the middle of the ocean and had a 100-pound weight strapped to your back, how long could you tread water?

If you didn’t know how long it would be until you were rescued, and, therefore how long you would be required to tread water, how hard would you work to shed the excess weight?

Question:

How can I get current expenses aligned with current revenue so that I am as close to cash flow neutral as quickly as possible?

This crisis represents a unique opportunity for some of us to take a hard look at the inefficiencies that have crept into our operations.

Here it is on a bumper sticker: Money spent that doesn’t support servicing your current customers and current revenue or on adding and servicing new customers is money wasted.

Since most of us are not in a growth mode during this crisis, a thorough and deep cleansing of our expense structure might be appropriate.

Besides, since it is unlikely that this will be the last time we must deal with this type of crisis, positioning your business for future economic shocks will be a competitive advantage.

Question:

What needs to change in my business model, expenses structure, and delivery of my product or service? What is the new messaging and promise I need to make to be relevant to my target audience?

The level of engagement and intensity of doctors in an emergency room is vastly different from what typically happens elsewhere in the health care system.

In an emergency room, speed, optics and intensity are your friend. A PowerPoint presentation on the need for regular exercise and a gluten-free, vegan diet will kill a patient that’s currently experiencing a heart attack.

Whatever your level of intensity and focus was prior to this crisis, double it. If you are driving your car on a straight highway in the middle of West Texas in the middle of a perfect day, you might get by with glancing at your most recent text messages.

But if it is bumper-to-bumper traffic on a steep, winding, icy road in the middle of the night and you are even slightly distracted, you will die. Conditions are treacherous, so engage appropriately if you plan to survive this crisis.

Question:

Where are the opportunities for me to eliminate distractions and minor irritants, refocus, and seize the steering wheel of my business like my life depended on it… because it does?

If you have been (or are attempting to become) the orchestra conductor of your business, consider stepping off the podium and becoming the first chair violinist.

This might be the time for you to become much more active in your business. If you survive, you can always exchange your bow for the baton.

Question:

Where are the places in my business that my direct involvement would help move the needle on survival and stability?

The difference between academics and business owners is academics develop a view and then argue with each other about it. Business owners develop a view and then bet on it.

In a crisis, being thoughtful and strategic about your view is critical, but taking action is mandatory.

Paralysis consumes cash!

Question:

Where am I paralyzed? How much is that costing me? What is the math about my situation? What decisions can I no longer argue with myself about?

Every failure of leadership has at its root a lack of courage.

As the owner or member of the management team of your business, you signed up for this.

You must have the courage to make the tough calls, have the hard conversations, and ensure the continuity and stability of the business.

In the immortal words of Bill Belichick (one of the greatest football coaches who has ever lived): “Do your job!”

Question:

What is my job? Am I doing it? If not, what needs to be corrected?

Now… Go THINK! You will thank me later.

For more business and CEO strategies, go to my website: www.KeystotheVault.com.